Strategies for Successful Long-Term Investments

In today’s markets, achieving stable returns through an investment portfolio remains a major challenge for investors. At Triton Asset Management, we firmly believe that it is our responsibility to share our investment experience with our clients. We know that learning is an ongoing process and that our clients want to develop their knowledge of investment categories, possible solutions and related issues such as risk control and regulatory / legal issues.

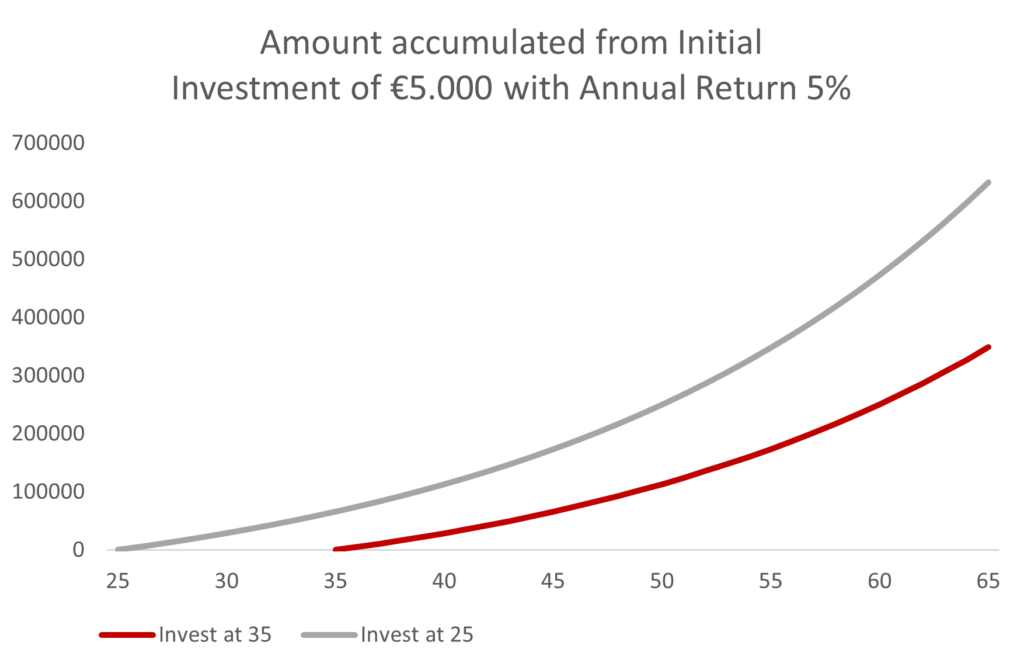

Start early and reinvest your profits

Compounding interest yields impressive results.

Research has shown that delaying the investment of your savings in our life cycle can result in a significant loss in our overall gains. Furthermore, reinvesting any accumulated profits from previous years leads to accelerated growth of ones invested capital over time.

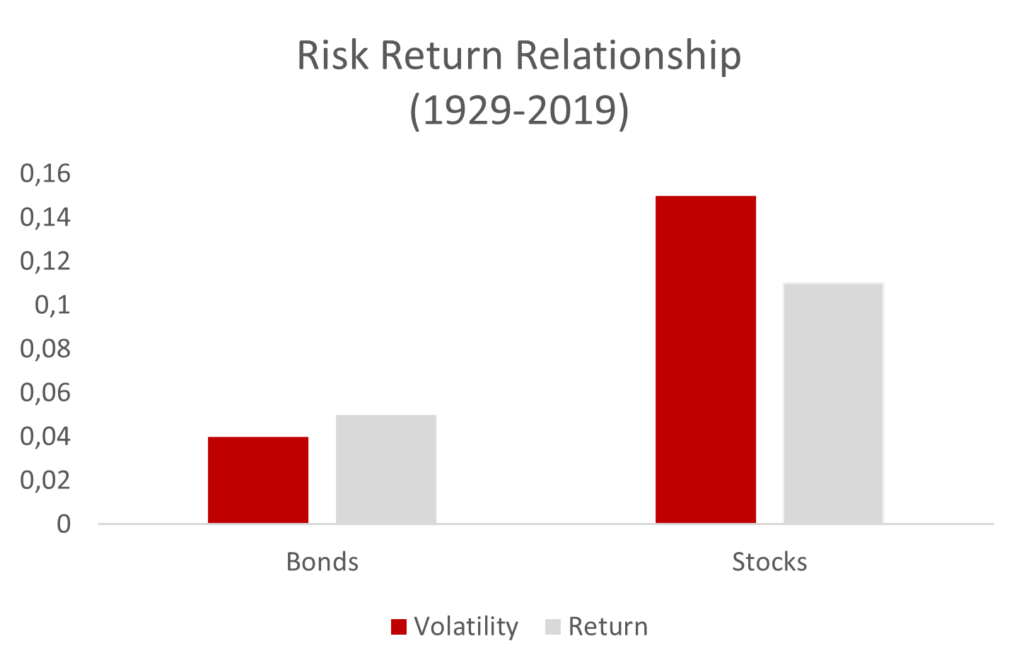

Risk and returns are inextricably linked

Be realistic about your goals and what you can achieve.

The best performing investments since the early 2000s tend to be the ones with the most volatile prices. Shares, for example, have experienced some sharp fluctuations in their value, but have yielded relatively strong annual returns compared to deposits that remained invested in the bank.

Therefore, if you want to aim for a higher level of return, you must be willing to tolerate greater fluctuations in the value of your investments along the way.

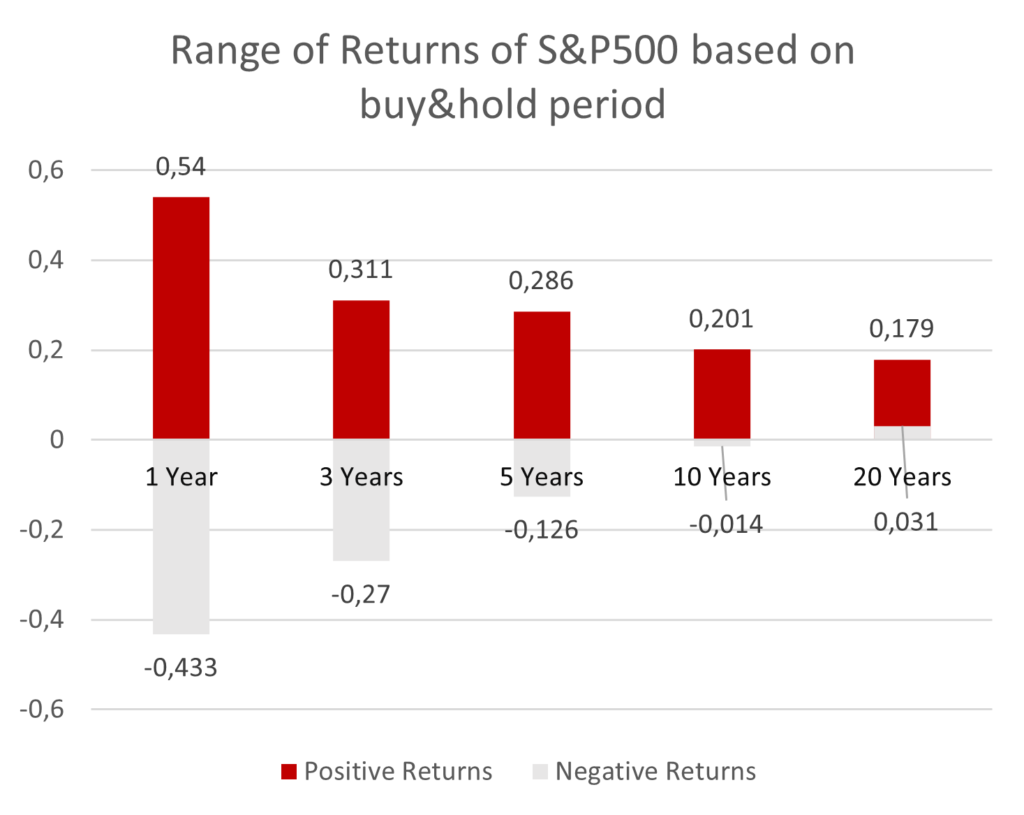

Investment risk and volatility is a given

Stay cool during volatile market times. Although market fluctuations are difficult to predict accurately, sharp declines are a fact of life and should be expected.

While there have been declines in every calendar year since 1986, the stock market continues to rise over two-thirds of the year and offer positive returns.

In other words, while stock markets are the ones with the most volatility and declines, 75% of the last 40 years have had positive returns for European stocks.

Choosing the optimal investment or deinvestment time is very difficult

The option to stay invested for a long time even in periods of high volatility is oftentimes the best option. It is crucial to maintain a long-term investment horizon.

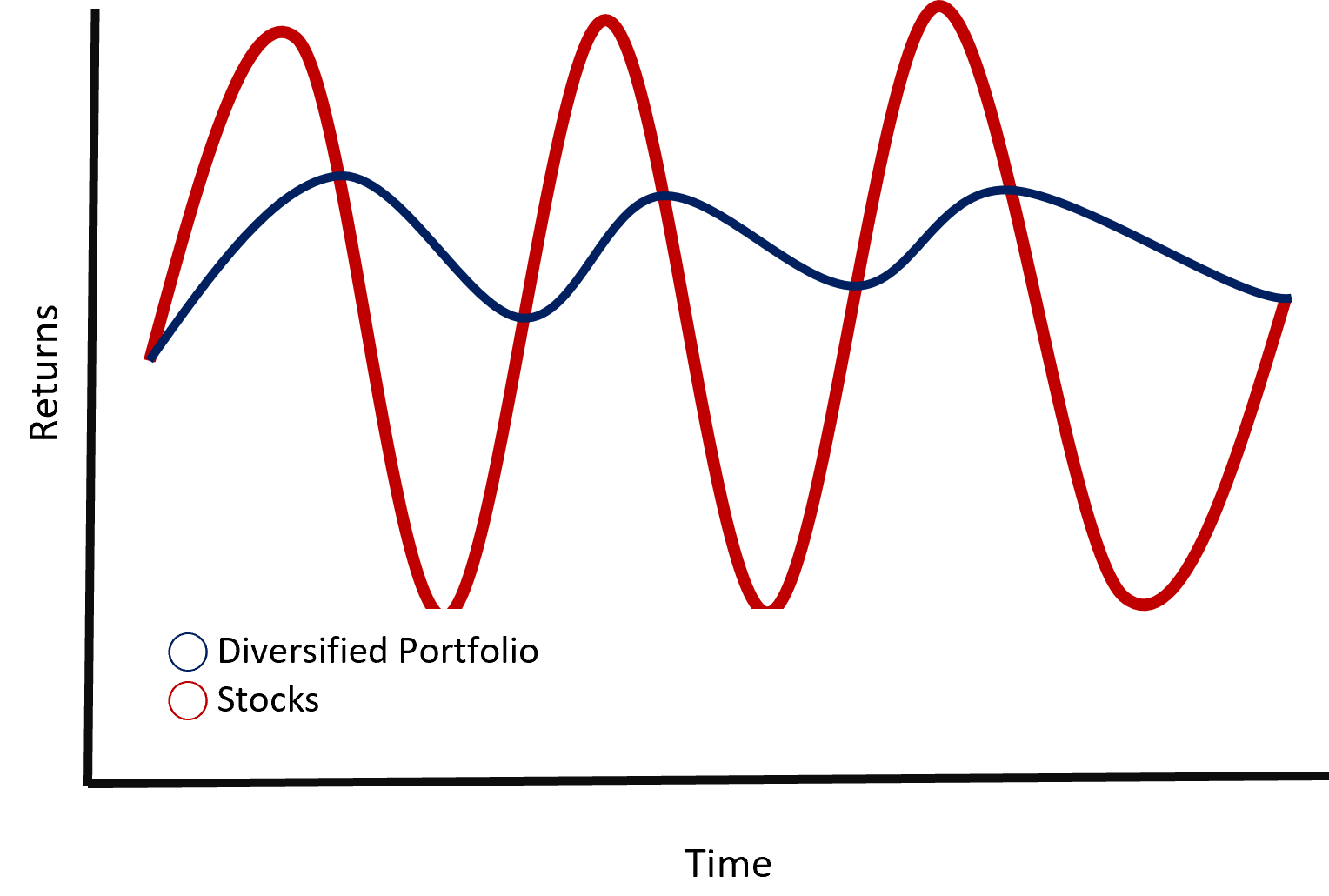

Diversification is very important

Diversified investment portfolios are historically signigificantly less volatile.

Despite the turbulent course for investors over the past 10 years, our analysis shows that a diversified portfolio offers much smoother returns than an investment limited to stocks.

As a result, a diversified portfolio of shares, bonds and other asset classes helps to limit sharp changes in returns.